vermont sales tax exemptions

This page discusses various sales tax exemptions in Vermont. Ad Your Business Partner for All Things Sales Tax.

Is A Small Business Llc Eligible For A Sales Tax Exemption

Sales Tax Exemptions in Vermont.

. Ad Keep up with changing tax laws. Ad Need a dependable sales tax partner. Changes to the Exemption for Industrial Machinery and Equipment Repairs.

Additionally wholesalers must pay a tax on spirits and fortified wines as follows. Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals. How to use sales tax exemption certificates in Vermont.

SALES AND USE TAX Subchapter 002. Transparent Flexible Fixed-Fee Pricing. Ad Fill out a simple online application now and receive yours in under 5 days.

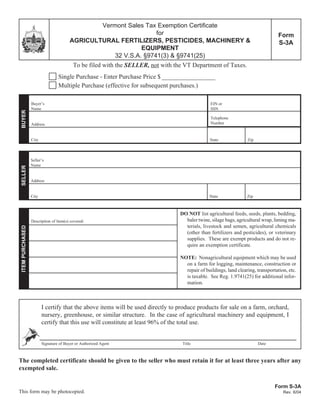

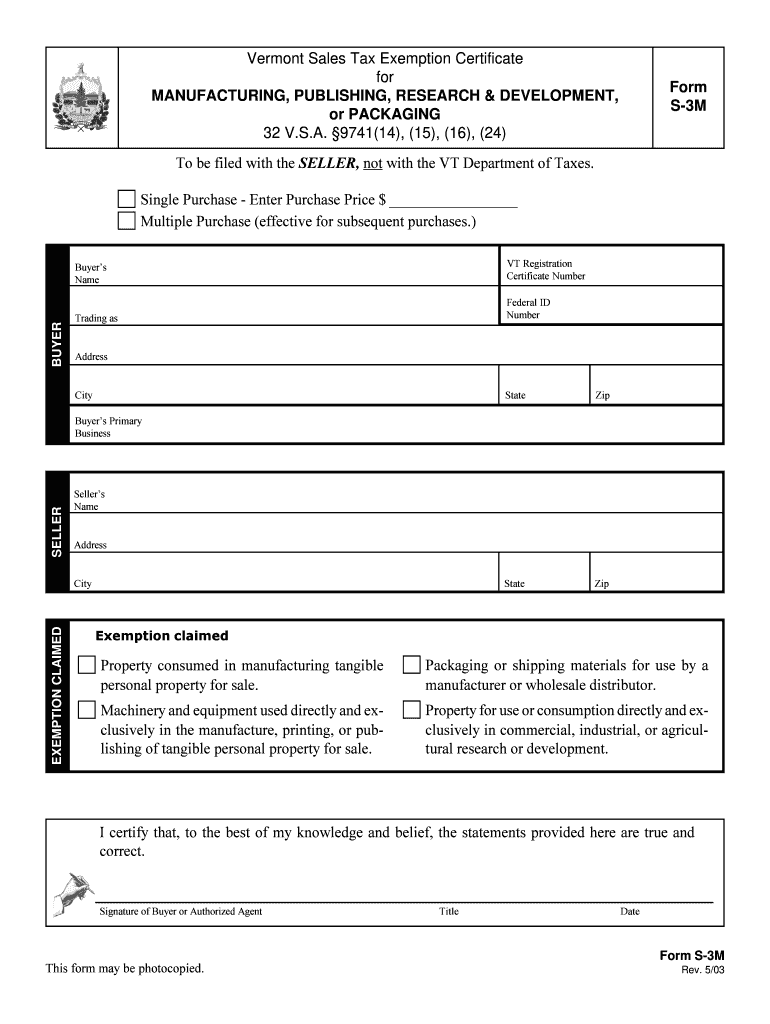

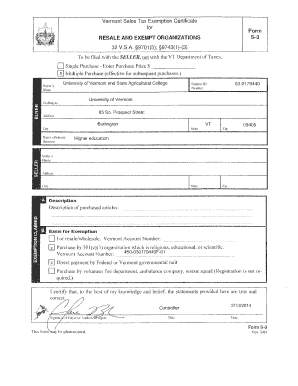

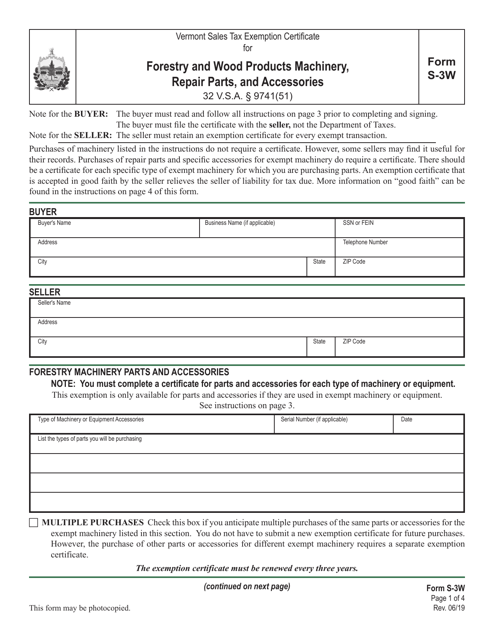

To obtain exemption from sales taxes this form must be completed and given to the supplier at the time of sale of th e property sold or service. State of Vermont Attached is a copy of the Resale and Exempt Organization Certificate of Exemption for the state of Vermont. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax.

All Major Categories Covered. Counties and cities can charge an additional local sales tax of up to 1 for. 9741 9741.

Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. The registrant or lessee must be licensed in Vermont as a VT Rental Company and will be required to submit a completed Rental Tax Exemption form VD-030. You will need to present this certificate to the vendor from whom you are.

In Vermont certain items may be exempt from the sales tax to all. Retail sales and use of the following shall be exempt from the tax on retail sales imposed under section. Find a more refined approach to sales tax compliance with Sovos.

Get the Avalara Tax Changes Midyear Update today. This vehicle is also classified as a Jitney and should be registered as such. The Vermont Statutes Online Title 32.

Ad Your Business Partner for All Things Sales Tax. Sales from 500001 through 749999. 25000 plus 10 percent of any amount over.

53 rows Exemption extends to sales tax levied on purchases of restaurant meals. Taxation and Finance Chapter 233. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

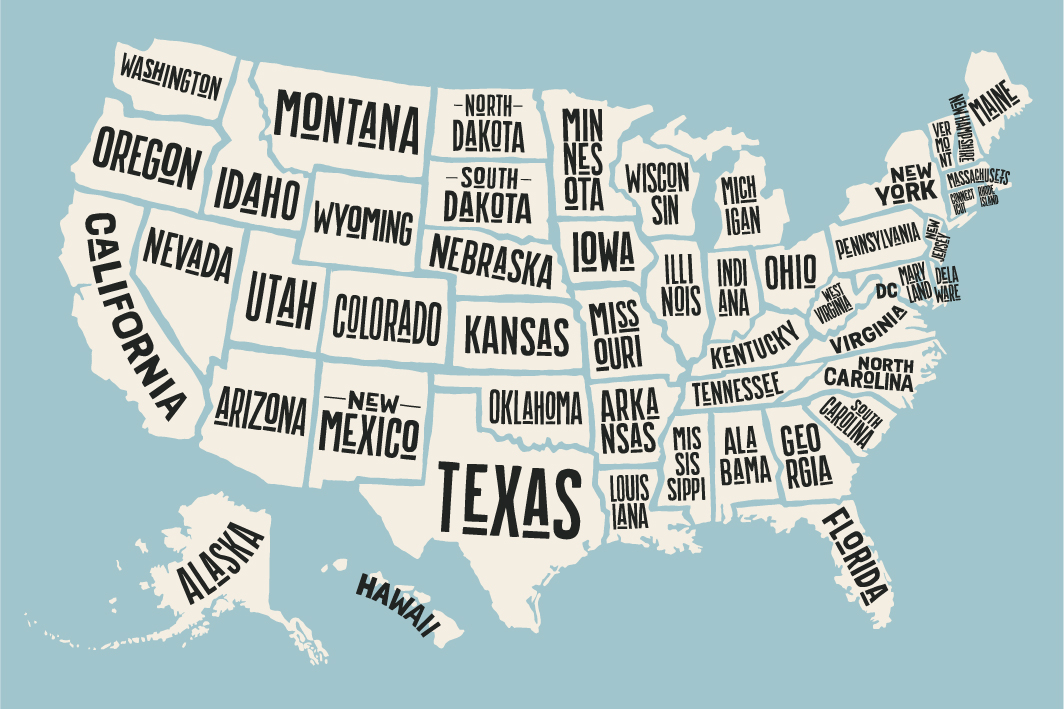

Beer over 6 percent alcohol by volume. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Effective July 1 1999 a sales and use tax exemption was enacted for labor charges for the repair of and parts and materials used in the repair of and incorporated into.

Florida State Manufacturing Exemptions. Registration Tax and Title. Sales up to 500000.

While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Sovos is your sweet spot for sales tax compliance. Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals.

Transparent Flexible Fixed-Fee Pricing. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Select Popular Legal Forms Packages of Any Category.

_0.png)

Map State Sales Taxes And Clothing Exemptions Tax Foundation

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Vermont Estate Tax Everything You Need To Know Smartasset

Sales Tax After The Wayfair Decision And How It Impacts You Youtube

Sales Tax Exemption For Resellers Support

Nonprofit Sales Tax Exemption Semantic Scholar

Vermont Sales Tax Exemption Certificate For Form S

Download Business Forms Premier1supplies

Vermont Grid Tie Solar Pv Installations O Meara Solar

Form S 3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

Vermont Sales Tax Calculator And Local Rates 2021 Wise

Vermont Sales Tax Exemption Certificate For Form Agricultural Fill And Sign Printable Template Online Us Legal Forms

Nonprofit Sales Tax Exemption Semantic Scholar

Vermont S Aging Population Spells Trouble For Tax Coffers Report Says Vtdigger